Asset Liability Immunization Strategy (ALIS) Insights 4th Quarter 2025 Outlook

November 12, 2025

Chad Rice, CFA®

Director of Retirement Investment Strategies, Senior Portfolio Manager

Executive Summary

- US corporate pension plans continued their resilience in Q3 2025, reaching historically high funded statuses driven by strong risk asset returns from both domestic and international securities.

- The economic landscape for the fourth quarter hinges significantly on the Supreme Court decision regarding existing tariffs, which is considered the lynchpin for the Trump administration's economic policy success.

State of the Markets

The third quarter of 2025 saw markets operating under an established global trading regime, featuring a base tariff rate of 10% and reciprocal tariffs on roughly 60 countries. This regime created a market respite, allowing stocks to trend higher during Q3. The estimated average effective tariff rate on imported goods is 23.1%, potentially raising $2.7 trillion in revenue over the next decade. Meanwhile, the bond market wrestled with a slightly softening job market, stubborn inflation metrics, and uncertain US debt and deficit picture. Finding clarity in this economic mix, the Fed lowered the target range of the Fed Funds Rate by 25 basis points in mid-September. The move was intended to approach a neutral policy stance, citing risks to both the inflation picture and concerns about a weakening employment environment.

The job market is softening, evidenced by the August unemployment rate rising slightly to 4.3%. However, this rate is still very robust compared to the 20-year average of 6.07% (2005-2025). Inflation remains persistent, with core or headline measures settling stubbornly around 2.7% to 3.0%, about 50% above the Fed’s 2% target. In the bond market, the 10-year Treasury yield moved slightly lower, declining from 4.23% to 4.15% by the end of the quarter.

Key Economic Influences and Events from Q3 2025

Tariff Regime Respite: Markets operated under the established global trading regime, featuring a 10% base tariff and reciprocal tariffs on approximately 60 countries. This stability provided a market respite, contributing to higher stock trends during the quarter. The estimated average effective tariff rate on imported goods is 23.1%.

Persistent Inflation Metrics: Inflation remained a stubborn influence, with core or headline measures settling consistently around 2.7% to 3.0%. This level is roughly 50% above the Fed’s 2% target. Influences like de-globalization, energy costs (due to AI datacenter buildout), and potential changes in real wage growth are pressures that may sustain inflation into the future.

Labor Market Softening: The job market exhibited signs of softening. The August unemployment rate rose slightly to 4.3%, although this remains very robust compared to the 20-year average of 6.07% (2005–2025). Labor market conditions were explicitly cited by the FOMC as the main driver for the September rate cut.

Fiscal Uncertainty: The bond market wrestled with the uncertain US debt and deficit picture. Investor anxiety over persistent deficit spending and outstanding federal debt led to investors driving up the term premium. U.S. interest costs relative to total tax revenue reached approximately 17.5%, a level not seen since the early 1990s.

Federal Reserve Easing: The Federal Reserve lowered the target range of the Fed Funds Rate by 25 basis points in mid-September. This move, the first rate cut since December 2024, was aimed at moving toward a neutral policy stance while addressing risks related to inflation and a weakening employment environment.

Pension Market Update

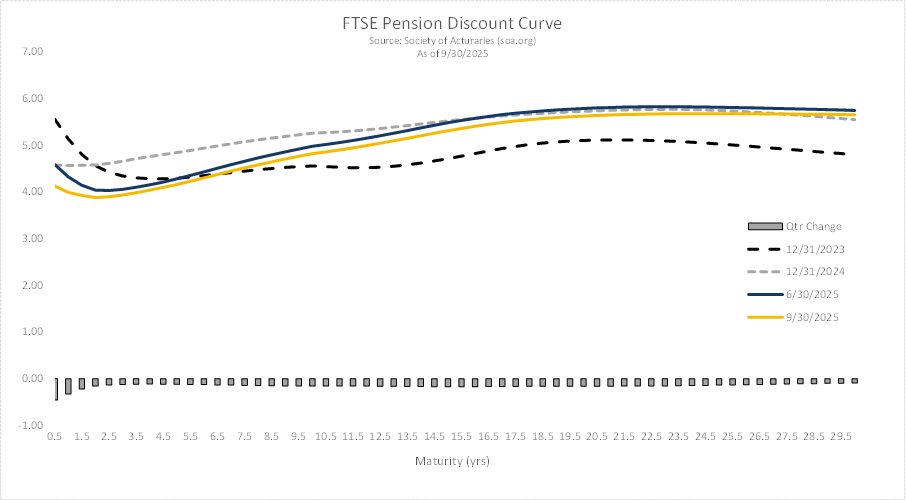

The third quarter of 2025 continued the trend of resilience and improved financial health for US corporate defined benefit pension plans. Funded statuses reached historically high levels, primarily driven by strong returns in risk assets despite a declining interest rate curve which increased the value of future liabilities. The aggregate funded ratio for US corporate pension plans showed robust growth throughout the quarter with the average index posting low single digit improvement.

Key Market Movements Influenced the Pension Market

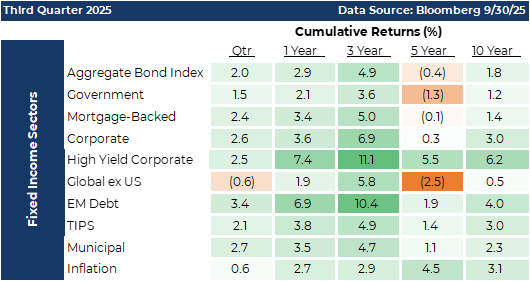

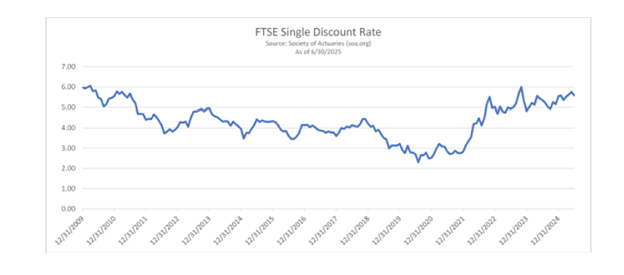

Treasury Yields and Discount Rates: The Federal Reserve’s decision to lower the target range of the Fed Funds Rate by 25 basis points in mid-September, citing labor market softening, contributed to higher liability valuations. The yield curve generally shifted downwards and steepened over the quarter, with shorter-term yields declining sharply due to anticipated rate cuts. Corporate bond yields used to value pension liabilities declined by more than 15 basis points in September, due to narrowing credit spreads and the Fed rate cut. Plan discount rates decreased by approximately 12 basis points in September, according to some monitors, contributing to a rise in pension liabilities.

Corporate Credit Spreads: Corporate credit spreads generally tightened over Q3. Aggregate US corporate spreads ended Q3 9 basis points tighter. The long maturity component of the credit curve outperformed on a spread basis, tightening by 10 basis points. However, the trend of credit risk acceleration—the number of fallen angels (downgrades from investment grade to below investment grade)—accelerated significantly in 2025. By May, $21 billion in downgrades had occurred. Approximately $112 billion of debt remains at risk of downgrade, including issuers like Ford and Boeing.

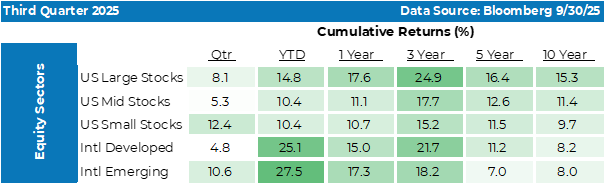

Domestic Equity Markets: Equity markets delivered solid performance throughout Q3, fueling asset growth. The S&P 500 Index generated a return of 8.1% for the quarter and was up 3.7% in September alone. For the year-to-date, the S&P 500 Index returned 14.8%. International Emerging Markets also showed strong gains, returning 10.6%. This performance helped drive pension plan funded statuses higher.

Economics: Pension plans are rapidly transitioning from accumulation to decumulation with nearly half of US plans paying out more than 7% of assets annually in benefits. This transition underscores the importance of proactive liquidity management. Effective strategies include using short-dated assets for predictable cash flows and implementing segmented portfolios of assets that can be quickly sold for less predictable needs. Selling assets to meet liquidity needs can be painful, incurring high transaction costs in stressed markets for public assets, and even more for illiquid assets including private securities.

Pension Risk Transfer (PRT) Market: Favorable market conditions, including high funding ratios and competitive pricing, have made this a great time for plan sponsors to de-risk. The market is trending towards terminations (purchasing annuities for all remaining participants to end the plan) rather than lift-outs (transferring a subset of participants). A survey indicated that 94% of insurers saw more plan terminations than lift-outs. The estimated cost to transfer retiree pension risk through a competitive bidding process decreased in August to 100.0% of a plan sponsor’s accounting liabilities. Insurers are actively building capacity, and many have adjusted their underwriting guidelines to improve their competitive advantage and bid on a broader range of transactions, including smaller deals, due to the lack of jumbo cases available.

Legal Precedent: A federal judge dismissed a significant lawsuit (Bueno et al. v. General Electric Co. et al.) challenging GE’s 2020 PRT with Athene. The judge ruled that the plaintiffs lacked standing because they continued to receive all payments owed, confirming they had not suffered an “injury in fact”. The court explicitly stated that the loss of ERISA protections as a result of a PRT is not a legal injury because ERISA permits plan termination through PRT.

Economic Outlook

The fourth quarter economic landscape hinges significantly on the Supreme Court case regarding the International Emergency Economic Powers Act (IEEPA). A lower court previously found that President Trump exceeded his presidential authority in enacting tariffs. If the Supreme Court upholds this decision, the President may pursue alternative methods, though the most durable approach would require passage by both houses of Congress. Tariffs related to national security, such as those targeting trafficking from China, Canada, and Mexico concerning the fentanyl crisis and border issues, may have a stronger standing than the base 10% tariff. If the Court upholds the trafficking tariffs, which impose effective rates 25 to 35 percentage points higher than before on key trading partners, they could raise between $145 billion to $250 billion annually. On the high end, this annual revenue could nearly make President Trump’s $2.8 trillion, 10-year One Big Beautiful Bill nearly deficit neutral.

The Supreme Court decision is thus the lynchpin for the administration's economic policy success. The market is already nervous, evidenced by investors driving up the term premium (the yield demanded for lending money for incrementally longer periods). This reflects anxiety regarding outstanding federal debt, persistent deficit spending, and political division. U.S. interest costs relative to total tax revenue have climbed to approximately 17.5%, nearly 70% higher than a decade ago and a level not seen since the early 1990s. This strain, combined with reduced liquidity, precedes the risk of a doom loop where borrowing increases at ever higher yields simply to pay interest.

Persistent inflation is another critical challenge. Influences like de-globalization, energy cost pressures due to AI datacenter buildout, and potentially elevated real wage growth from immigration changes may sustain price pressures. Absent a recession, these sustained inflationary pressures will be an unexpected challenge for the Fed over the next couple of years. The Fed's actions may lean toward cautious moves with more meaningful increments, departing from typical tightening/easing cycles. Furthermore, the Federal Reserve faces political dynamics, as noted by the Trump Administration's efforts to fire a Board of Governors member and pressure the Chairman to resign. An independent Fed is vital to prevent fiscal dominance, where the central bank keeps short-term borrowing costs low to enable continued deficits.

Regarding monetary policy mechanisms, the Fed has reduced the pace of Quantitative Tightening to $5 billion per month. A related metric, the reserves-to-bank-liabilities ratio, is currently below 14%, a level that previously precipitated a rise in short-term borrowing rates in 2018. The Fed is managing this transition from abundant to ample reserves by feel, and going too far could cause funding markets to misbehave. Additionally, repurchase agreement (repo) rates are seeing an increasing yield spread compared to the Fed funds rate, indicating potential, though perhaps premature, funding stress in a market that sees over $1 trillion in trade volume daily.

If tariffs are upheld by the Supreme Court, market fear may subside, uncertainty is removed, and the term premium should reduce, lowering intermediate and long-term bond yields. Upholding tariffs offers an unexpected tool to check the deficit, potentially decrease Treasury issuance, and bolster the dollar. Conversely, if tariffs are disallowed (ignoring a successful workaround), projected deficits associated with the One Big Beautiful Bill Act will likely shock markets. This scenario would worsen the term premium, expand de-dollarization, cause higher borrowing costs, and risk bond markets due to anticipated Treasury auction challenges and increased issuance. The lack of tariff revenue may push the resolution of the deficit crisis until funding markets are forced to make tough decisions.

Looking beyond immediate fiscal concerns, the progression of artificial intelligence (AI) is expected to disrupt the economy significantly. AI could vastly increase productivity, which would suggest a dramatically higher neutral rate for Fed policy, potentially colliding with elevated unemployment levels as AI furthers the value of capital over labor. This seismic change poses immense social, tax policy, security, and governance challenges, raising questions about future savings rates and the widening divide between the wealthy and the working class.

Investment Strategy

The Federal Reserve’s quantitative tightening and shrinking balance sheet are reducing bank reserves, requiring careful management to avoid market disruptions. The reserves-to-liabilities ratio has dipped below 14%, raising concerns seen in previous market stress periods, while repo market spreads signal potential funding pressure. The Supreme Court’s upcoming decision on tariffs could significantly impact the U.S. economy: if tariffs are upheld, they may help reduce deficits and support the dollar, but if overturned, increased deficits, higher yields, and weaker market confidence could follow. Artificial intelligence could further disrupt the labor market and productivity, presenting new policy challenges for the Fed. Strategy-wise, a cautious approach favors short-term bonds and selective long bonds, as the market awaits clarity on rates, deficits, and tariff policy, with active management essential in these uncertain times.

Investment advisory services are offered through Advanced Capital Group ("ACG"), an SEC registered investment adviser. The information provided herein is intended to be informative in nature and not intended to be advice relative to any specific investment or portfolio offered through ACG. The views expressed in this commentary reflect the opinion of the presenter based on data available as of the date this was written and is subject to change without notice. Information used is from sources deemed to be reliable. ACG is not liable for errors from these third sources. This commentary is not a complete analysis of any sector, industry, or security. The information provided in this commentary is not a solicitation for the investment management services of ACG and is for educational purposes only. References to specific securities are solely for illustration and education, relative to the market and related commentary. Individual investors should consult with their financial advisor before implementing changes in their portfolio based on opinions expressed. |